Proforma Invoice in sap is mainly employed in export transactions. in this article, we will discuss how pro forma invoices work in the Sales & Distribution module.

Table of Contents

An invoice is an important document issued by a seller to the buyer for goods or services. The invoice lists the elements of the transaction, which are typically summarized in three sections: dates, items, and prices. It is usually in the form of a paper-based letter with specific units. The use of proforma invoices in SAP is a standard business practice used in many countries worldwide. Proforma invoices are an essential part of accounting. This is because they are used to record the costs associated with a particular project or operation, which can then be adjusted for other purposes.

Pro forma invoices are used to report the cost of products to the customs department to estimate duties/levies or to request advance payment by the purchaser. Proforma invoices are exactly the same as Invoices. The only difference is that the Pro forma invoice does not need to be paid for and does not transmit information into FI(Financial accounting).

Pro forma invoice, and you can create a pro forma invoice for the same delivery / Order can create as many times as you want. It is unnecessary to have a Goods Issue to be included in creating a Proforma invoice, and proforma invoices do not generate account entries.

The pro forma invoice is used primarily for export customers, and they need it to get their goods cleared through customs. It’s the same way you would create an invoice so long as you’ve followed the copy-writing rules.

A Pro forma invoice is an invoice that is used for purpose of documentation only. Certain government agencies may require pro forma invoices instead of quotations since proforma invoices mirror the images of the invoices to be received when conducting transactions. It’s a duplicate of the initial invoice, which will be sent out at a later time.

Pro forma invoices can be created for delivery documents and sales documents according to the SAP standard Configuration. There isn’t an accounting document that is generated for this Proforma invoice.

There are two kinds of Pro forma Invoices. These areas follow

On the basis of a Sales Order document, we can create a Proforma invoice. Create the sales order using (VA01). Then, create the Proforma invoice in reference to the sales Order using billing type F5.

.We may also make Pro forma invoices with reference to a delivery document. Create a delivery document using the VL01N transaction code then we need to create a proforma invoice using references in the delivery documents using billing type F8.

Processing Professional pro format invoice is sightly different from regular invoices processing. Here are below differences you might be noticed when you are looking at pro forma invoice & commercial invoice

We need either a New Billing type or Change an existing billing type in the below menu customizing Option to use pro forma invoice

Display IMG ->>Sales & Distribution ->>Billing- >>Billing Document ->>Define Billing Document Type

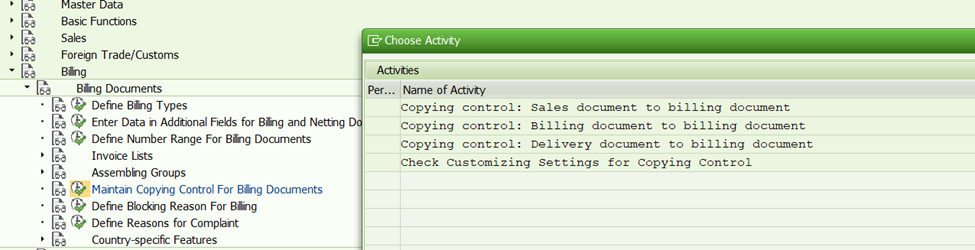

Finally, in order to transfer data from a sales order to a billing document, we must configure copy control settings. To accomplish the foregoing, you’ll need copy control, of course.

Because no quantity reduction happened during the generation of the pro forma invoice, the “pos./neg. quantity” field is assigned to “BLANK.”

When you copy the controls in the copy control, it is possible to disable the ” Billing quantity +ve/-ve” field is kept off, meaning that if you do accident, you are unable to change the amount in the Billing field

It’s the same as a normal process of billing. Proforma invoices can be made from sales orders or delivery documents. It’s F5 Order-related Proforma Invoice & F8 Delivery-related Proforma Invoice if we’re making Proforma Invoice in reference to a Sales Order.

Then, visit t.code VF01 and enter the order number into the “Billing Type ” field, select “F5” and click “Enter” and the order is now registered. Proforma Invoice will be generated. Similar to that, if you wish to create a delivery related Proforma invoice, go to VF01, type in the number for the delivery document in the field, and then Select “F8 ” from the “Billing type ” drop-down menu, then press Enter.

Select “F5” as the billing type manually, then enter the Sales document number in the “Document” section and press the Enter key.

Select “F8” as the billing type manually, then enter the delivery document number in the “Document” section and press the Enter key.

Transaction VF11 can be used to cancel normal customer invoices.. But if you try to cancel a pro forma invoice using the same transaction, you will get the below error message.

Because no FI posting is produced during the initial pro forma invoice creation, the system behavior is accurate. As a result, there is no need to create a canceled invoice. If any FI postings need to be reversed, a canceled invoice is required.

a proforma invoice in SAP" width="975" height="427" />

a proforma invoice in SAP" width="975" height="427" />

We must follow the steps below to cancel a pro forma invoice:

You Might Also Like the below articles

![]()

Follow us

We are a group of SAP Consultants who want to teach and make studying tough SAP topics easier by providing comprehensive and easy-to-understand learning resources.